CEC Bank sets sights on more ambitious goals

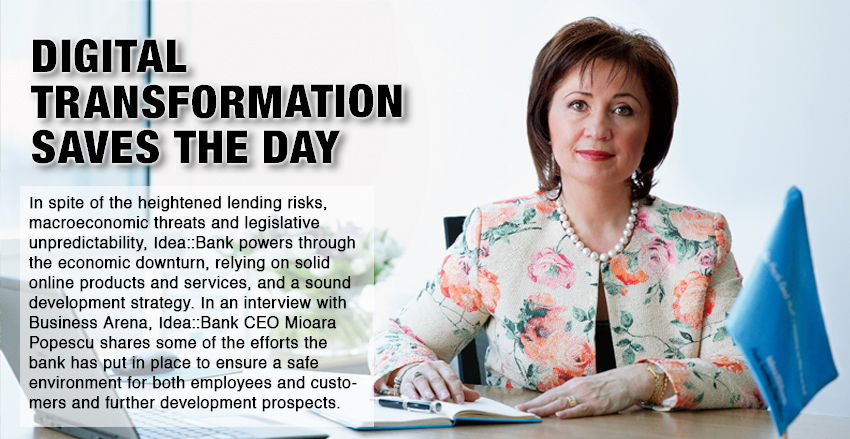

As the end of the year is coming closer, CEC Bank looks back on its achievements with pride. In an interview with Business Arena, Mihaela Lucica Popa, Director, First Vice President of the Board, CEC Bank, outlines this year's highlights and the prospects for 2020.

What were CEC Bank's main achievements in 2019 and what are the bank's objectives for 2020?

In 2019, CEC Bank aimed to strengthen its status as a universal commercial bank, to preserve its position among the top banks in the Romanian banking system, to significantly expand its offer of products and services, to train its staff and modernize its technical platform.

Thus, CEC Bank has seen a significant improvement in the quality of assets and a very good lending track record in 2019, expanding its loan portfolio both in the corporate and retail segments, and there are no expected changes in that trend before the end of the year. Also, we continued our technological modernization program, investing in modern services and processes that are digitally accessible, with the main objective of improving the quality of services offered to customers. Another proud moment was the European Commission's historic decision to accept CEC Bank's recapitalization by its shareholder, the Romanian Government, without being considered state aid. We are the largest Romanian bank with fully state-owned capital, having the largest territorial branch network, and, based on our mission statement, we will continue to support mainly SMEs, the agriculture and population, paying special attention to providing co-financing for EU-funded projects.

At the same time, 2019 is a year with important historical connotations for CEC Bank – an institution that has become a national symbol and a landmark for authentic Romanian values over the years. On November 24, our bank celebrates 155 years of existence.

We are a strong, modern and competitive bank, and the results so far are proof to our achievements. The bank's success story has been and continues to be written by dedicated people, who have not only created a team, but a true family. Thanks to them, at its 155th anniversary, CEC Bank is among the top banks in Romania.

Can you describe one of the challenges that CEC Bank has had to overcome this year?

The capitalization process has been the biggest challenge for our bank this year. This is why the success of this initiative gives us the opportunity to expand and consolidate our lending capacity and provides the best conditions for us to improve our IT systems, with a direct impact on customer satisfaction. Now, it is up to us to carry on the bank's 155-year-old success story in the Romanian banking and financial market.

In the context of a competitive local market, which market segments have been identified to provide growth opportunities for CEC Bank?

As a state-owned bank, we have a special business vision: we are interested in making a profit, but our responsibility goes beyond our

own institution, aiming at the development of the Romanian economy as a whole.

According to our short-term strategy, SME and agriculture lending programs represent key elements in the commercial development of

the bank. We strongly believe in the ability of Romanian companies to perform, and in this regard we are actively involved in supporting

the business environment, entrepreneurship and the SME segment, by developing and launching dedicated, flexible and competitive financing products. CEC Bank currently finances more

than 11,000 companies, while there are about 12,000 truly "bankable" companies in Romania.

We are also very active financing in agriculture. Our bank has a large portfolio of lending products and services for customers in rural areas: investments (including land acquisitions), financing of current activity, inventory financing loans, etc.

We also provide loans for government programs, such as the Start-Up Nation, National multi-annual microindustrialization program, Program for development of commercial operations for market products and services, “Investeste in tine”, etc.

To what extent has CEC Bank been affected by the legislative instability in Romania and what are your expectations regarding the country's economic prospects in 2020?

All legislative projects, including those aimed at or impacting the banking system, must be the subject of a constructive,

open and transparent dialogue between all the parts involved. Thus, any differences of opinion can be effectively solved by the participating entities, before any changes become effective. Otherwise, the reaction of the public, of our customers in this case, can be one of distrust in the system, with negative effects in the medium and long term.

As for the economic prospects for 2020, the signals in the market are positive. Romania's economy has seen growth rates that represent historic maximums in the last few years, placing us at the top of the EU ranking, which is also expected to have a positive influence on the banking system.

What are your main professional goals for 2020?

Banking is not easy, on the contrary. It is an area full of challenges that involves a lot of work. In September 2007, when I joined CEC Bank's management team, I had the opportunity to become involved in one of the most ambitious projects on the Romanian banking market: the transformation of a symbolic institution for Romania, the Savings Bank, into a universal, modern and competitive commercial bank,

CEC Bank.

Although the task has not been an easy one, I can say that CEC Bank's story is one of success, because we have managed to achieve both a change in the bank's image and its financial revival. From this experience, I've learned, once again, that success favors those who show openness towards new ideas and constructively acknowledge possible failures. This is also why I appreciate the transformational, visionary, charismatic and inspirational leadership, strongly promoted in recent years.

Therefore, my main professional goal for 2020 is to carry on this success story, together with my colleagues in CEC Bank's management team, with more ambitious goals to benefit our customers, individuals, SMEs, large companies, and, last but not least, all our 6,000 colleagues throughout the country.

In 2019, CEC Bank aimed to strengthen its status as a universal commercial bank, to preserve its position among the top banks in the Romanian banking system, to significantly expand its offer of products and services, to train its staff and modernize its technical platform.

Thus, CEC Bank has seen a significant improvement in the quality of assets and a very good lending track record in 2019, expanding its loan portfolio both in the corporate and retail segments, and there are no expected changes in that trend before the end of the year. Also, we continued our technological modernization program, investing in modern services and processes that are digitally accessible, with the main objective of improving the quality of services offered to customers. Another proud moment was the European Commission's historic decision to accept CEC Bank's recapitalization by its shareholder, the Romanian Government, without being considered state aid. We are the largest Romanian bank with fully state-owned capital, having the largest territorial branch network, and, based on our mission statement, we will continue to support mainly SMEs, the agriculture and population, paying special attention to providing co-financing for EU-funded projects.

At the same time, 2019 is a year with important historical connotations for CEC Bank – an institution that has become a national symbol and a landmark for authentic Romanian values over the years. On November 24, our bank celebrates 155 years of existence.

We are a strong, modern and competitive bank, and the results so far are proof to our achievements. The bank's success story has been and continues to be written by dedicated people, who have not only created a team, but a true family. Thanks to them, at its 155th anniversary, CEC Bank is among the top banks in Romania.

How was 2019 for the banking system?

In 2019, the banking and financial sector continued its consolidation process. The capitalization of the banks was satisfactory, and asset quality has improved. Profitability was high in 2018 and in the first months of 2019, while the risk and financing costs were lower.Can you describe one of the challenges that CEC Bank has had to overcome this year?

The capitalization process has been the biggest challenge for our bank this year. This is why the success of this initiative gives us the opportunity to expand and consolidate our lending capacity and provides the best conditions for us to improve our IT systems, with a direct impact on customer satisfaction. Now, it is up to us to carry on the bank's 155-year-old success story in the Romanian banking and financial market.

In the context of a competitive local market, which market segments have been identified to provide growth opportunities for CEC Bank?

As a state-owned bank, we have a special business vision: we are interested in making a profit, but our responsibility goes beyond our

own institution, aiming at the development of the Romanian economy as a whole.

According to our short-term strategy, SME and agriculture lending programs represent key elements in the commercial development of

the bank. We strongly believe in the ability of Romanian companies to perform, and in this regard we are actively involved in supporting

the business environment, entrepreneurship and the SME segment, by developing and launching dedicated, flexible and competitive financing products. CEC Bank currently finances more

than 11,000 companies, while there are about 12,000 truly "bankable" companies in Romania.

We are also very active financing in agriculture. Our bank has a large portfolio of lending products and services for customers in rural areas: investments (including land acquisitions), financing of current activity, inventory financing loans, etc.

We also provide loans for government programs, such as the Start-Up Nation, National multi-annual microindustrialization program, Program for development of commercial operations for market products and services, “Investeste in tine”, etc.

To what extent has CEC Bank been affected by the legislative instability in Romania and what are your expectations regarding the country's economic prospects in 2020?

All legislative projects, including those aimed at or impacting the banking system, must be the subject of a constructive,

open and transparent dialogue between all the parts involved. Thus, any differences of opinion can be effectively solved by the participating entities, before any changes become effective. Otherwise, the reaction of the public, of our customers in this case, can be one of distrust in the system, with negative effects in the medium and long term.

As for the economic prospects for 2020, the signals in the market are positive. Romania's economy has seen growth rates that represent historic maximums in the last few years, placing us at the top of the EU ranking, which is also expected to have a positive influence on the banking system.

What are your main professional goals for 2020?

Banking is not easy, on the contrary. It is an area full of challenges that involves a lot of work. In September 2007, when I joined CEC Bank's management team, I had the opportunity to become involved in one of the most ambitious projects on the Romanian banking market: the transformation of a symbolic institution for Romania, the Savings Bank, into a universal, modern and competitive commercial bank,

CEC Bank.

Although the task has not been an easy one, I can say that CEC Bank's story is one of success, because we have managed to achieve both a change in the bank's image and its financial revival. From this experience, I've learned, once again, that success favors those who show openness towards new ideas and constructively acknowledge possible failures. This is also why I appreciate the transformational, visionary, charismatic and inspirational leadership, strongly promoted in recent years.

Therefore, my main professional goal for 2020 is to carry on this success story, together with my colleagues in CEC Bank's management team, with more ambitious goals to benefit our customers, individuals, SMEs, large companies, and, last but not least, all our 6,000 colleagues throughout the country.

The interview is also available in our print edition of Business Arena.

S-ar putea să îți placă:

COMENTARII:

Fii tu primul care comenteaza